north dakota sales tax on vehicles

These guidelines provide information to taxpayers about meeting their tax. IRS Trucking Tax Center.

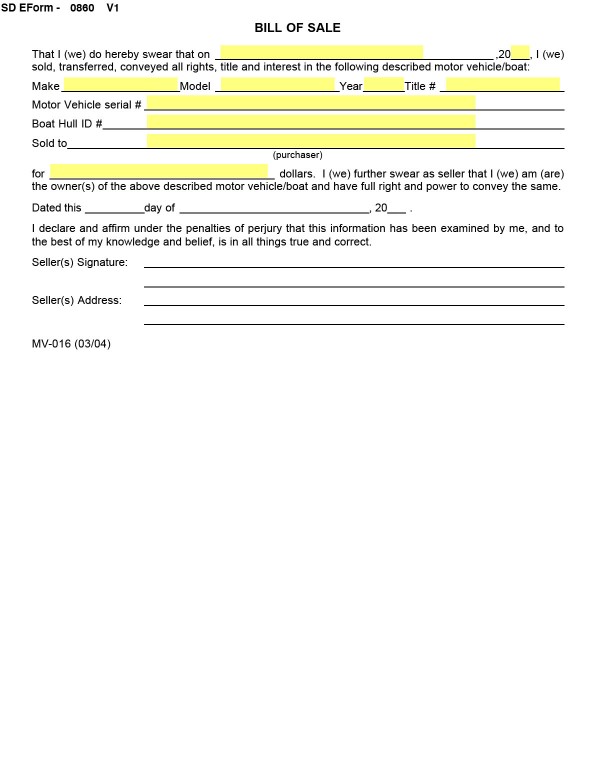

Bills Of Sale In South Dakota The Forms And Facts You Need

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. The average local tax rate in North Dakota is 0959 which brings the total average rate to 5959. 57-55-102 for periods less than 30 days in this state. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by the seller.

North Dakota sales tax is comprised of 2 parts. Motor vehicle fuel tax. Updates are posted 60 days prior to the changes becoming effective.

Includes diesel kerosene biodiesel compressed natural gas. 57-55-102 for periods less than 30 days in this state. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on.

Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. North Dakota Title Number. Ad Lookup Sales Tax Rates For Free.

New farm machinery used exclusively for agriculture production at 3. If you live in North Dakota you will always pay a flat 5 sales tax. For vehicles that are being rented or leased see see taxation of leases and rentals.

The rate on farm machinery irrigation equipment farm machinery repair parts and new mobile homes was increased from 35 to 4. Or the following vehicle information. In North Dakota there are 3 types of motor fuel tax.

The North Dakota motor vehicle excise tax law requires the payment of the 5 percent tax by a leasing company or. North Dakota levies a state sales tax rate of 5 percent for most retail sales. The statewide and county sales tax are not applied to vehicle purchases.

The North Dakota 5 percent sales tax applies on the rental charges of any licensed motor vehicle including every trailer or semi trailer as defi ned in NDCC. Motor vehicle fuel includes gasoline and gasohol. The North Dakota 5 sales tax applies on the rental charges of any licensed motor vehicle including every trailer or semi trailer as defined in NDCC.

However this does not include any potential local or county taxes. Do I have to pay sales tax on a used car in North Dakota. And the rate on alcoholic beverages was increased from 65 to 7.

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Make online payments using credit or debit card. Patriotic Plate Series Information Sheet. Motor Vehicles North Dakota Office of State Tax Commissioner.

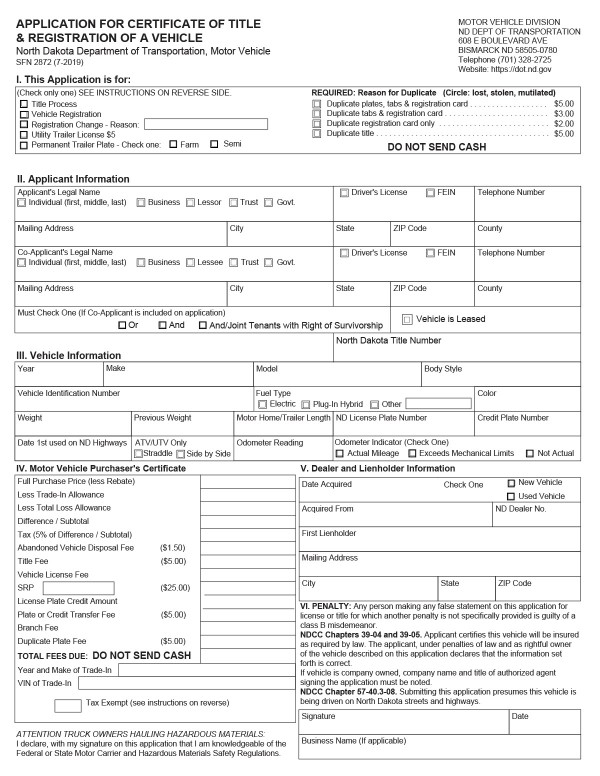

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. SDL 32-5-2 are also exempt from sales tax. To calculate registration fees online you must have the following information for your vehicle.

You can find these fees further down on the page. Our free online North Dakota sales tax calculator calculates exact sales tax by state county city or ZIP code. The sales tax is paid by the purchaser and collected by the seller.

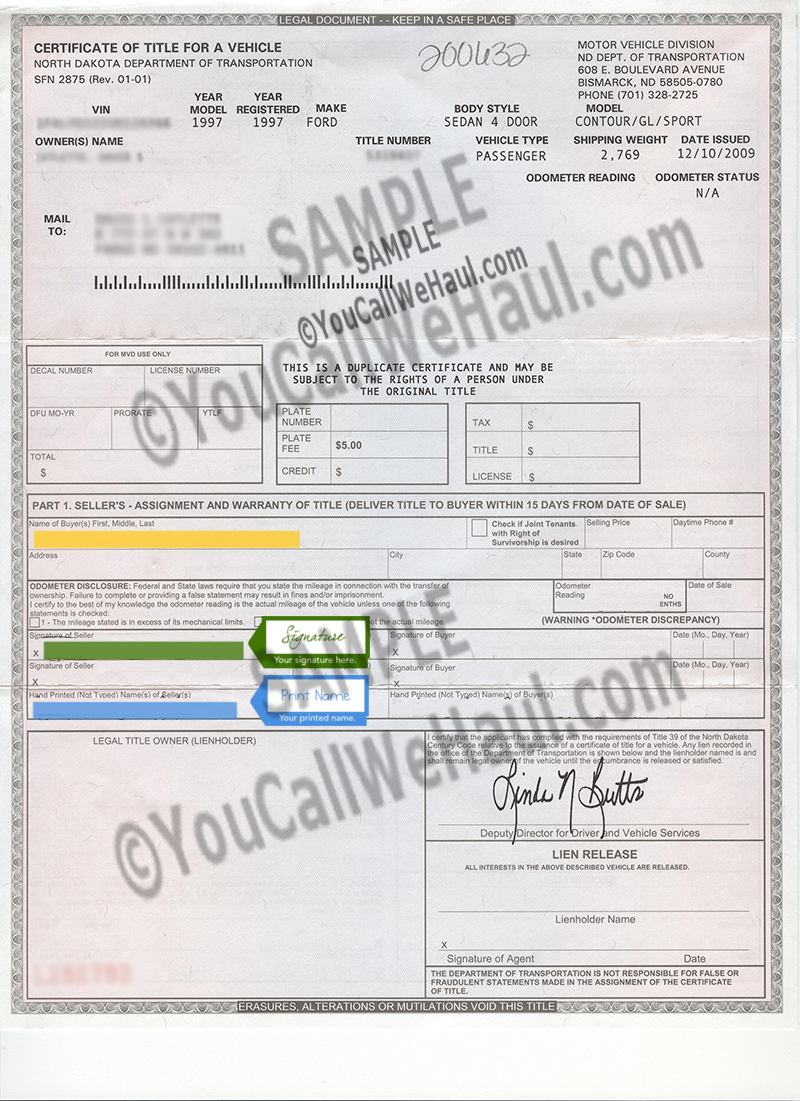

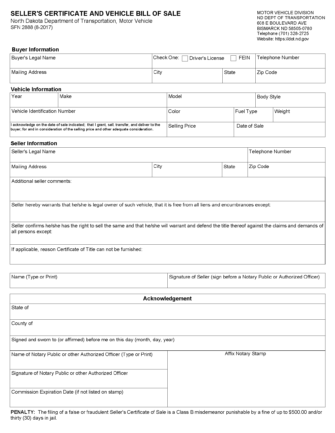

Some taxpayers may qualify for a refund on motor vehicle fuel tax. New local taxes and changes to existing local taxes become effective on the first day of a calendar quarter. Completed showing selling price date of sale and current odometer reading which is required on all motor vehicles less than ten 10 years old.

Motor vehicles exempt from the motor vehicle excise tax under. This includes the following see. The state also allows.

The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2. By using the North. Learn more about different North Dakota tax types and their requirements under North Dakota law.

Selling a vehicle with North Dakota title. ND Motor Vehicle Sites. Motor Vehicle Plates FAQ.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. Cities and special taxation districts. When the owner of a vehicle.

Please contact 844-545-5640 for an appointment. Year first registered of the vehicle this will be within one year of the model Shipping or gross weight of the new vehicle required depending on the type of vehicle. 023 per gallon sold to retailers and consumers.

Key Takeaway If youre buying a new or used car in North Dakota you will be charged a 5 sales tax. Interactive Tax Map Unlimited Use. What is the sales tax on a car purchased in North Dakota.

How to calculate sales tax on a car in North Dakota. Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers. I recently registered my vehicle in North Dakota and then moved out of state.

Includes gasoline and gasohol. The sales tax is computed and collected. Vehicle Questions Answers.

The sales tax on a car purchased in North Dakota is 5. Volunteer Emergency Responder License Plate Fact Sheet. Any motor vehicle excise use or sales tax paid at the time of purchase will be credited.

Title transfer fee is 5. Car loan in North Dakota 2022. Gross receipts tax is applied to sales of.

Certain items have different sales and use tax rates. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. License fees are based on the year and weight of the vehicle.

The motor vehicle excise tax must be paid to the North Dakota department of transportations motor vehicle division when application is made for registration plates or for a certificate of title for a motor vehicle. The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6.

What S The Car Sales Tax In Each State Find The Best Car Price

North Dakota Vehicle Title Donation Questions

South Dakota Vehicle Title Donation Questions

North Dakota Vehicle Donation Title Questions Vehicles For Veterans

North Dakota Auto Title Services Auto Title Bonded Title Surety Bonds Tax Registration

Free North Dakota Motor Vehicle Dmv Bill Of Sale Form Pdf

Car Sales Tax In North Dakota Getjerry Com

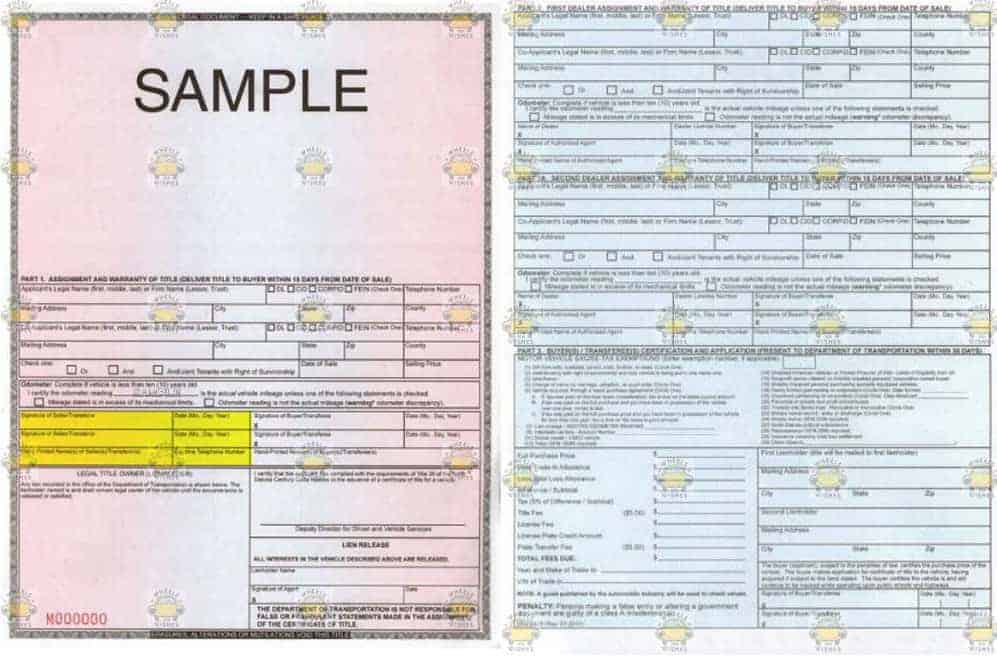

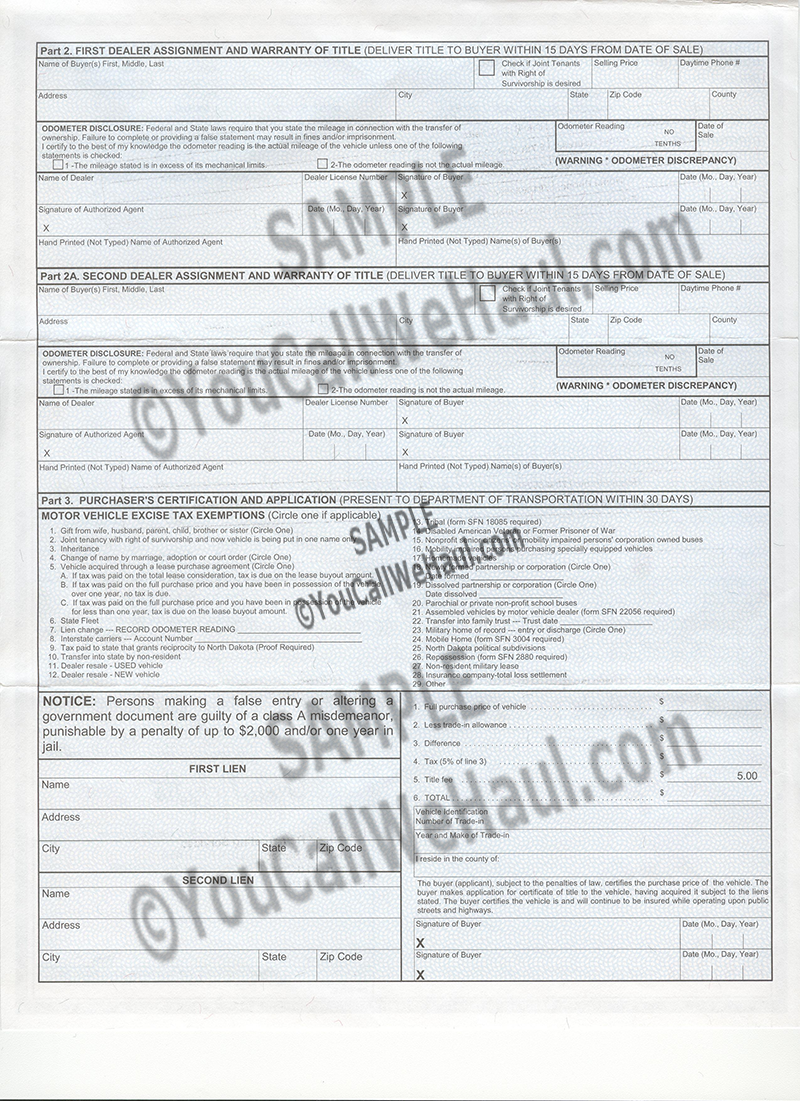

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

My Vehicle Title What Does A Car Title Look Like

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

North Dakota Sales Tax Handbook 2022

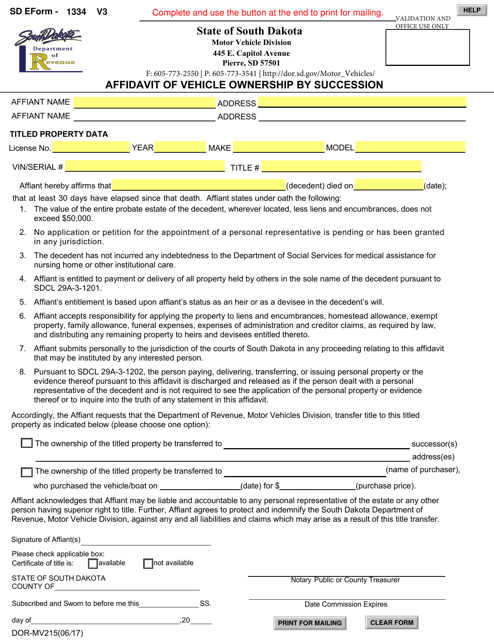

Sd Form 1334 Dor Mv215 Download Fillable Pdf Or Fill Online Affidavit Of Vehicle Ownership By Succession South Dakota Templateroller

About Bills Of Sale In North Dakota What You Need To Know

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

Free North Dakota Bill Of Sale Forms Pdf Word

North Dakota State Vehicle Title Transfer Guide Sell My Car Now